Amidst medical advancements and stronger demand for healthcare services, the landscape of healthcare is transforming at an accelerated pace, and we must relook at the role of insurance companies in championing sustainable healthcare practices across the value chain. This starts with taking a long view to understand how the healthcare ecosystem will be shaped and key considerations for insurers when tailoring products.

As a leading insurer in the Asia Pacific health landscape, Allianz Asia Pacific’s purpose is to provide security for our customers’ futures and ease their burdens when major events occur, bringing them peace of mind.

The trust and reputation cultivated worldwide are instrumental in providing the strong foundation that Allianz stands on in the region, operating in nine markets across 14 operating entities to support the demand for health insurance.

Our strength lies in our network, and bringing the power of Allianz together in any market makes us more successful than if we were to operate individually.

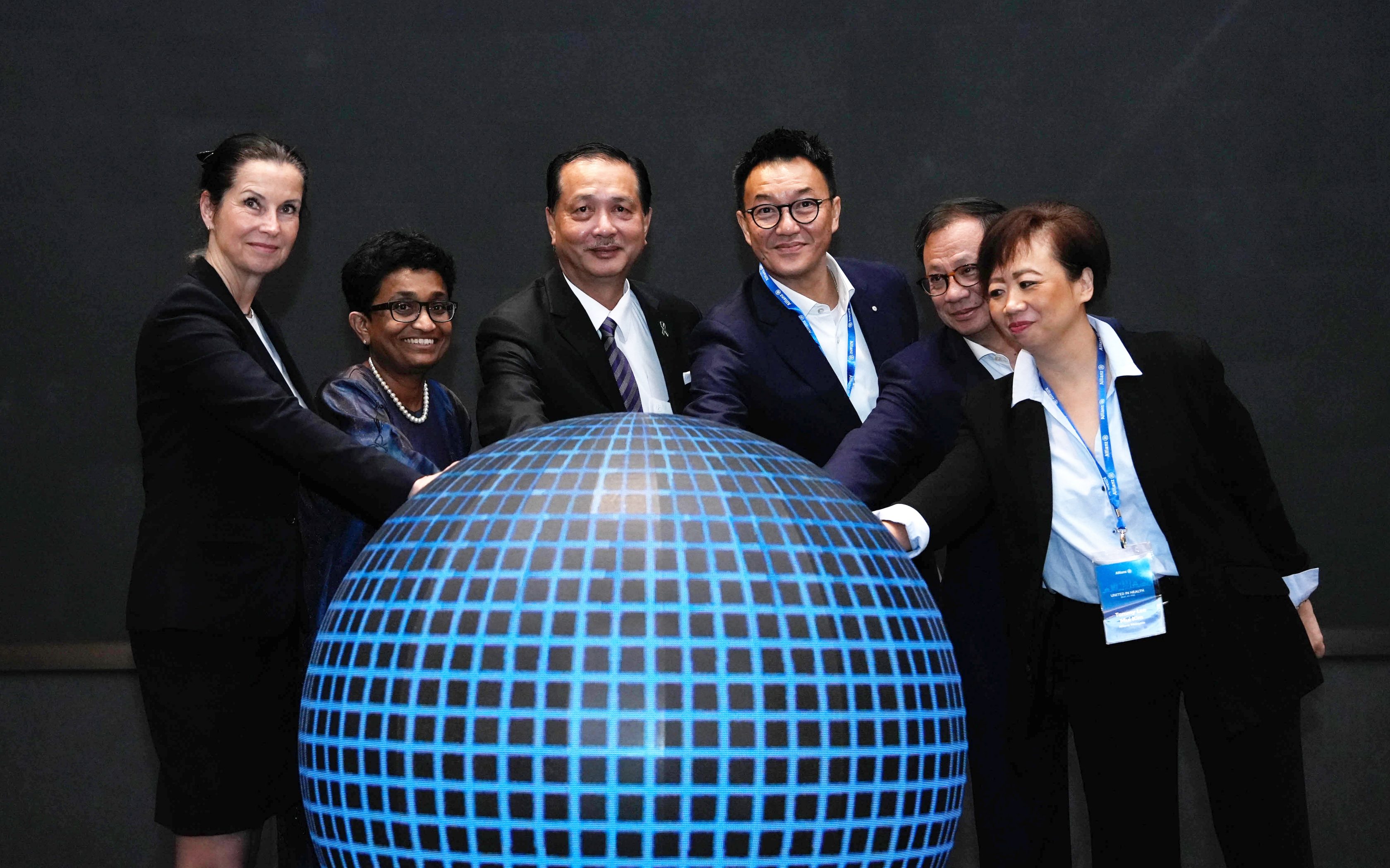

While we stand on a solid foundation for health, the responsibility to provide affordable access to quality healthcare is a collective one and requires partnership among all stakeholders. In that spirit, we organised the inaugural Allianz Asia Health Summit in 2024, uniting our global operating entities, insurers, regulators, providers, and distributors to engage in dynamic, in-depth and meaningful discussions on tackling medical inflation, health propositions and the emergence of health tech.

We were honoured to have National Heart Institute Malaysia chairman Tan Sri Dr Noor Hisham Abdullah as a panellist at the summit and for his support in the launch of our Health Centre of Excellence headquartered in Kuala Lumpur, Malaysia.

Key takeaways from the summit’s panels were on the effective containment of medical inflation, on the latest medical technologies available for early detection of illnesses, ensuring the effective utilisation of data and AI, and how insurers can adapt to emerging medical technologies to bring greater value to customers.

“We have all the right ingredients to propel our health footprint in Asia. Through strategic collaborations and synergies among all players within the healthcare value chain, we can ensure a collective win to make a difference in each life we touch.

From governments to insurers, regulators, providers, and distributors, each voice adds a unique perspective to health insurance—a safety net against unforeseen health challenges.

Together, we shape a resilient tomorrow, ensuring our customers find comfort in wellrounded protection,” said Allianz Asia Pacific regional chief executive officer Anusha Thavarajah.