- Global insurance premiums increased 3.7% to 3.66 trillion euros in 2017

- China set to become world’s largest insurance market – with premiums growing ~13% in coming years

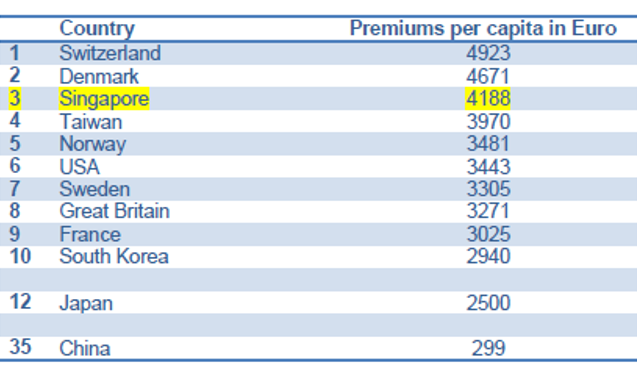

- Singapore is #3 worldwide in terms of premiums per capita; expected to achieve premium growth of ~5% p.a. over next decade

Singapore, 26th April 2018 -- According to projections by Allianz Research, the global insurance premium volume last year rose to a new record sum of 3.66 trillion euros (excluding health insurance). Compared to 2016, the nominal increase adjusted for exchange rate effects is 3.7%.

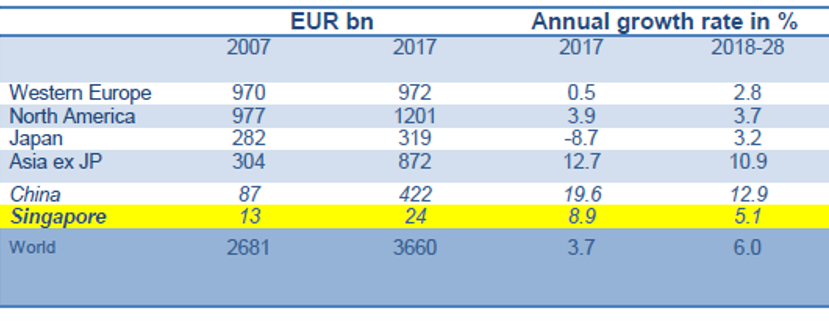

Property-casualty insurance set the tone last year: with a growth rate of 5.0% in 2017, it not only grew almost twice as fast as life insurance (+2.8%), but also recorded the largest increase since 2012. Nevertheless, the growth discrepancy between the regions remains striking: while premiums in Western Europe, for example, rose by a meagre 2%, Asia ex-Japan soared by 10.2%. The top performer in the region and worldwide last year was India, with bumper growth of above 30%.

Asia ex-Japan also had another strong year in life, with premiums surging by almost 14% in 2017. One country in particular stood out: China. Of the approximately 60 billion euros in additional premiums in life worldwide, around 80% were attributable to the Chinese market. In both lines combined, last year's global premium growth totaled just under EUR 130 billion. Asia ex-Japan accounted for 76% of the increase, with China accounting for more than two thirds of this.

"Asia is setting the pace for insurance markets, in particular in life," commented Michael Heise, Chief Economist of Allianz. "The development is nothing less than amazing. This is part of a broader trend - the region succeeded in transforming high growth rates into mass wealth. The new Asian middle class is now not only driving insurance markets, but many consumer markets. Asian savers and shoppers are the growth engine for the world economy.”

Allianz Research expects insurance markets to continue to recover, with premium growth forecast to reach around 6% in the next decade. This upturn primarily reflects the return of the global economy to normal growth and inflation rates. Growth expectations for Asia (ex Japan) are notably higher – the region should achieve growth of almost 11% p.a. over the next decade. At the end of the 2020s, around 40% of global premium income should be written in the region; 10 years ago, this figure was around 10%. And at the top there will be a historic change of guard: China will overtake the USA as the largest insurance market.

“Global insurance markets are undergoing fundamental changes," said Kathrin Brandmeir, economist at Allianz Research. "However, from our point of view, this disruption also offers great opportunities. With the new technologies, insurance cover can be made accessible and tangible for more people, and insurance products can become more attractive. If we succeed in getting customers so enthusiastic about insurance that they would again spend as much of their income on insurance cover as before the crisis, global premiums could be about 1 trillion euros higher at the end of the next decade than in our baseline scenario.”

Insurance premiums in property-casualty and life*

Insurance markets by premiums per capita*

*based on 2017 exchange rates

The interactive “Allianz Global Insurance Map” can be found on our global page here